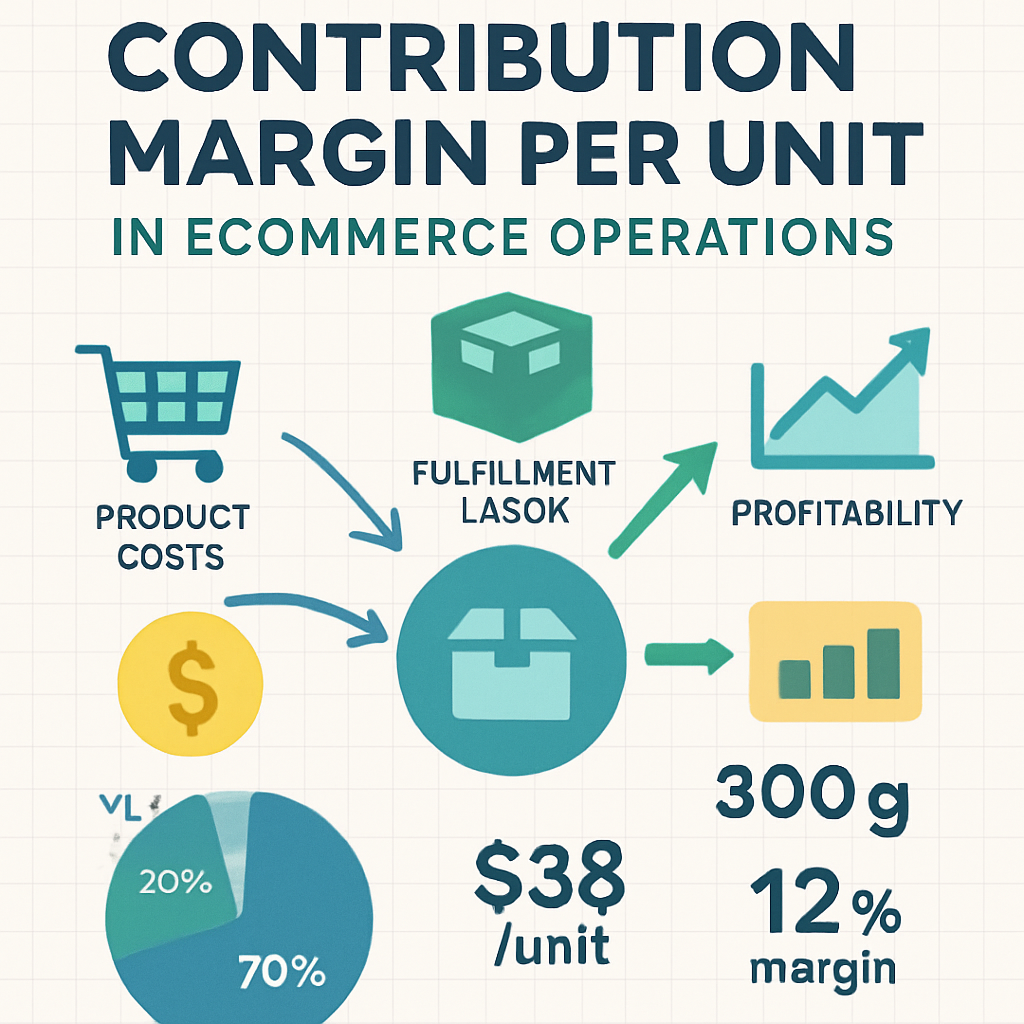

Contribution margin per unit in ecommerce operations is the amount each unit sold contributes after all variable product, fulfillment, and selling costs are deducted. It reflects the true unit-level economic value of selling one additional item.

1. What it is (Definition)

Contribution margin per unit is the amount of money each individual unit sold contributes toward covering fixed costs and generating profit, after all variable costs associated with that unit are deducted from revenue. In ecommerce operations, it represents the true unit-level economic value of selling one item through a specific channel and fulfillment setup.

Unlike overall contribution margin, which can be calculated at the order or channel level, contribution margin per unit isolates performance at the SKU level. It answers a precise operational question: when one more unit is sold, how much value does it actually add to the business.

Contribution margin per unit focuses only on variable costs that scale with each unit sold. These typically include product cost, pick-and-pack labor, shipping and packaging, payment processing fees, and marketplace or platform fees. Fixed overhead costs are intentionally excluded.

For ecommerce brands, contribution margin per unit is one of the most actionable profitability metrics. It links pricing, fulfillment, and inventory decisions directly to unit economics.

2. Who it’s for

Contribution margin per unit is especially important for mid-market ecommerce brands and aggregators operating between $5M and $100M in annual revenue. At this scale, small differences in unit economics compound quickly as order volume grows.

Shopify-based ecommerce businesses use contribution margin per unit to understand the profitability impact of pricing changes, free shipping thresholds, and fulfillment options. Two products with similar prices can have very different unit margins once shipping and handling costs are included.

Amazon and Walmart third-party sellers rely heavily on per-unit contribution analysis because marketplace fees and fulfillment costs vary by product size, weight, and fulfillment method. Contribution margin per unit helps identify SKUs that look attractive on revenue but underperform economically.

Multichannel ecommerce teams use contribution margin per unit to compare how the same product performs across channels. A SKU may have a strong unit margin on direct-to-consumer orders but a weaker margin on marketplaces due to fees or fulfillment structure.

Contribution margin per unit becomes increasingly critical as SKU counts increase and inventory decisions must be prioritized based on economic impact, not just sales volume.

3. How it works

Contribution margin per unit starts with the selling price of a single unit. From that price, all variable costs incurred to sell and deliver that unit are subtracted.

Variable costs typically include cost of goods sold, fulfillment labor, packaging, outbound shipping, payment processing fees, and any marketplace or platform commissions tied directly to the sale. Marketing costs may be included when analyzing contribution margin per unit at the campaign or channel level.

The remaining amount is the contribution margin per unit. This value represents how much each unit sold contributes to covering fixed costs such as salaries, software, and facilities, and eventually to operating profit.

In practice, teams calculate contribution margin per unit by SKU and by channel. This reveals differences driven by fulfillment method, shipping distance, or fee structures. Products with similar gross margins can have very different contribution margins per unit once fulfillment and channel costs are applied.

Contribution margin per unit is often used to guide pricing, promotions, and inventory prioritization. SKUs with stronger unit contribution can justify higher service levels and inventory investment, while weaker contributors require tighter control or revised pricing.

4. Key metrics

Inventory turnover interacts with contribution margin per unit through capital efficiency. A SKU with a strong contribution margin per unit but slow turnover may still strain cash, while a fast-turning SKU with solid unit contribution improves liquidity.

Sell-through rate affects realized contribution margin per unit. If inventory does not sell as planned and requires markdowns, the effective contribution margin per unit declines even if initial economics were sound.

Weeks of supply influences margin risk. Excess weeks of supply increase the likelihood of discounts, storage costs, and obsolescence, all of which reduce contribution margin per unit over time.

Fill rate impacts unit economics indirectly. Poor fill rates result in missed sales opportunities and wasted acquisition spend, lowering the effective contribution generated by each unit of inventory held.

Together, these metrics show that contribution margin per unit is not isolated. It is tightly connected to how efficiently inventory is planned, positioned, and sold.

5. FAQ

Is contribution margin per unit the same as gross profit per unit?

No. Contribution margin per unit includes all variable selling and fulfillment costs, not just product cost.

Can contribution margin per unit vary by channel?

Yes. Fees, shipping costs, and fulfillment methods differ by channel, often creating large unit-level differences.

Should low contribution margin per unit SKUs be discontinued?

Not always. Some may play strategic roles, but they require careful inventory and pricing control.

How does contribution margin per unit affect inventory planning?

Higher unit contribution typically justifies higher inventory investment and service levels, while lower contribution requires leaner stocking.

Why is contribution margin per unit important for scaling?

Because growth multiplies unit economics. Scaling weak unit contribution amplifies financial risk, while strong unit contribution compounds profitability.